Portfolio Management: A Lesson from Aunt Agatha

Ah, family stories, fertile ground for drama and funny anecdotes. We've all experienced at least one. Today, we're turning our attention to a particular subject, a source of much tension: investment portfolio management. Have you ever found yourself moping around because the funds you had invested in weren't making as much as you'd hoped, whereas two years earlier you thought you were a financial guru because your capital was multiplying faster than the neighbour's rabbits?

Don't worry, you're not an incompetent or a guru, but simply a victim of the vagaries of the market. Is this serious? No, but it could become so if you were misinformed. So, without further ado, let's dismantle - or rather burst - the bubble in the fable of market volatility.

Understanding Market Volatility

It's often difficult to understand changes in the value of our investments. Sometimes they go up, sometimes they go down. They never seem to decide which trend to follow, leaving us with a jagged chart that doesn't tell us much. Yet behind this childish squiggle lies a veritable ballet of assets, whose mistress of ceremonies is none other than the market volatility.

That's right, financial markets are highly volatile. If we were to risk looking at the historical returns of the famous stock market index S&P500 from 1900 to 2023, and classifying each year according to its percentage return, we would find that in 95% of cases, the return is between -30% and +50%. In other words, by investing 100,000 euros, you could earn between -30,000 and 50,000 euros a year! Granted, this range is so wide that it's almost like saying that the answer to the question "Are you all right?" lies somewhere between euphoria and affliction. And, even if you were rich enough or foolhardy enough to accept the risk of losing 30% of your investment, don't forget that in 5% of cases, or once every 20 years on average, the market can fall below -30% (or, similarly, rise above 50%). This happened in 2008, when those unfortunate enough to have decided to invest were faced with a fall of -37%.

Yet this is the harsh reality of the markets. Returns can vary considerably from one year to the next, and even good diversification of the assets in our portfolio does not provide sufficient protection, much to the chagrin of investors.

But is that all? If even a well-diversified portfolio isn't enough, should we take back all our marbles and let ourselves be overwhelmed by the fear that market lightning will one day strike us down? Fortunately not, because we have another ally to help us manage our portfolio: temporal diversification.

Investing in the Stock Market with Aunt Agatha

To understand what this is all about, let's go back to family history and take the example of Aunt Agatha. Let's take a closer look at her family's portfolio management...

Aunt Agatha's Savvy Grandparents

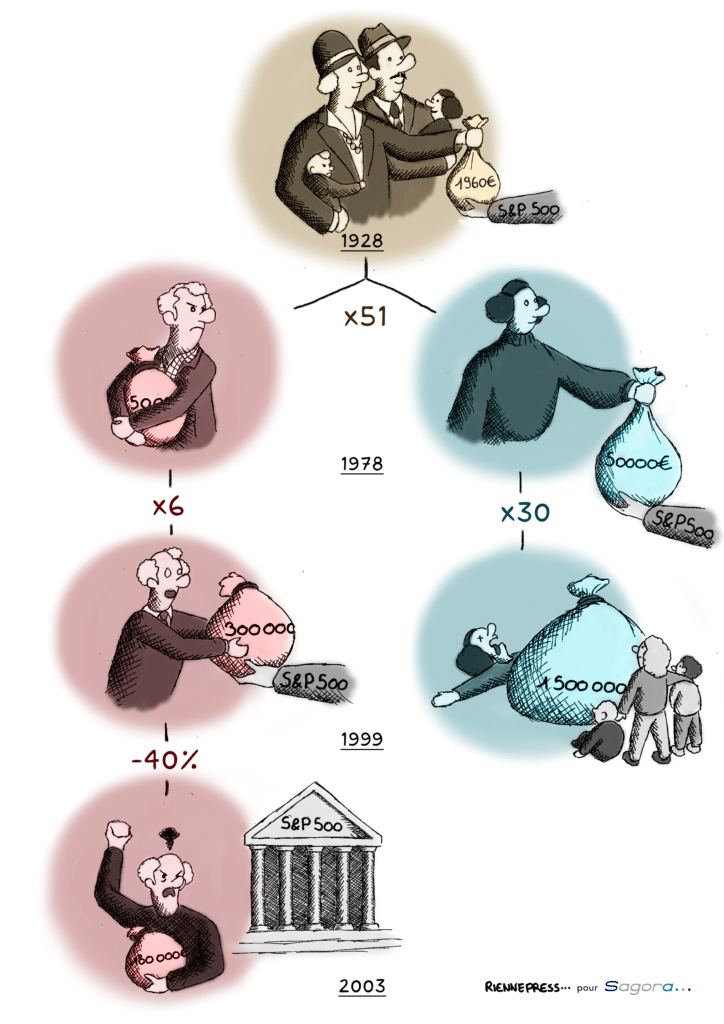

Aunt Agatha was lucky in life. Her grandparents, who were keen to leave an inheritance to their descendants and had a certain financial understanding, decided to invest €1,960 in a highly diversified portfolio of assets equivalent to the S&P 500 in 1928. When they died 50 years later, the money was withdrawn and left to their two children: Margaret and her brother, whom we shall call Leon. Time having done its work, the two ended up with a sum of around 100,000 euros, a 51-fold increase on their parents' initial investment!

Margaret, the Mother of Cunning Aunt Agatha and Timid Leon

Margaret, Aunt Agatha's mother, was not born yesterday, so she hastened to follow her parents' example by reinvesting her share in 1978, i.e. 50,000 euros, directly in the same stock market index. Her brother, Leon, was a bit of a couch potato and didn't trust his "thieving bankers", so he put the money into a savings account.

Under the Weight of Regret: the Contrasting Fortunes of Margaret and Leon

Time went by and, in 1999, Aunt Agatha's mother gave up the ghost and, having failed to be generous during her lifetime, she left an investment multiplied by a factor of 30, amounting to 1,500,000, to her children: Aunt Agatha and Uncle Seraphim, whose adventures we will have the pleasure of following over the next few articles. Sensing his turn was coming, and jealous of the success of his sister's portfolio management, Leon finally decided to enter the market at the beginning of the following year, with capital enriched by his savings of 300,000 euros. However, he quickly fell victim to the bursting of the internet bubble and withdrew his money precipitously in 2003, having lost almost 40% of his initial investment. Humiliated by this mediocre performance, and scorned by those close to him who saw him as a financial rookie, his hatred of bankers has never been greater.

Controlling your financial investments with Agatha and Seraphim's family

There are several lessons to be learned from this story. Firstly, the example of the grandparents and parents of Aunt Agatha and Uncle Seraphim shows that the importance of taking a long-term view when investing. By investing their money at an early stage, over several decades, they have seen their initial outlay multiply considerably, offering a substantial inheritance to their descendants.

Leon's story then goes on to demonstrate the importance of timing the market entry. Indeed, by delaying his investment until early 2000, he missed a period of significant growth and was faced with a market downturn when the internet bubble burst. Finally, Leon's failure shows the extent to which temporal diversification is important for a optimal management of the investment portfolio. By investing regularly over the long term rather than betting everything on the spur of the moment, on the strength of his sister's success, he could have avoided major losses following an extreme event.

Conclusion for A Worry-Free and Profitable Portfolio Management

To illustrate our point, we could continue this story with all the descendants of Aunt Agatha and Uncle Seraphim. In the financial markets, there is no shortage of unlucky victims of extreme events and sudden changes of direction.

Your success on the financial markets therefore depends on a number of factors that make you shy away from investing. The fact is, over the long term (10 to 20 years), the markets provide an average annual return of around 10%, i.e. your capital doubles on average every 8 years. However, it is important to remain vigilant in view of the very high volatility inherent in this type of market. financial markets. Consequently, the importance of your responsibility lies in diversifying your investments appropriately, both in terms of assets and timing, and in applying the concepts discussed throughout this article to take advantage of market volatility.

Key points to remember about portfolio management

- Financial markets are highly volatile.

- Even well-diversified portfolios are very risky.

- The timing of your entry into the market can have a significant impact on your investments, both upwards and downwards, which is why it is so important to spread your investments over time.

- Volatility can be reduced by diversifying not only in terms of assets but also over time.

- A long-term vision for your investments offers more opportunities to practise time diversification.

- However, risk is not something to be shunned and can yield substantial returns if the concepts discussed in this article are taken into account.

- Over the long term, well-diversified investments such as the S&P 500 have an average annual return of 10%, although it is essential to remain vigilant to their high volatility, which can be controlled over the long term through asset and time diversification.

If you would like to sail through the choppy waters of the financial markets with greater peace of mind, visit our website to find out more about our programme of portfolio management training !

Portfolio Management

Our portfolio management courses are offered at different locations and on different dates.

- 15, 17 and 19 July in Knokke

- 19, 21 and 23 August in Knokke

- 26 and 27 September in Luxembourg

- 28 and 29 November in Brussels

#PortfolioManagement #FinancePersonnelle #HéritageFamilial #StratégiedInvestissement #Diversification #FormationFinancière #KnokkeSummerSchool

References :

- Damodaran, A. (2024). Historical Returns on Stocks, Bonds and Bills: 1928-2023. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- Schmit, M. (2023). Banking and Asset Management. Understanding Banking Performance [Slides]. https://uv.ulb.ac.be/pluginfile.php/3821056/mod_resource/content/1/2022_Handout2_ING_Direct_Financial_risks.pdf

Keywords