The Man at the Top of the Ponzi Scheme

Madoff and the Ponzi Scheme

"In today's regulatory environment, it is virtually impossible to break the rules". These words of wisdom and faith in the effectiveness of our institutions were shared with us by one of the greatest swindlers in financial history. He is, of course Bernard Madoff, a legendary Wall Street figure, who not only broke the rules but also plundered the securities accounts of his numerous victims under the noses of the Security & Exchange Commission (the stock market 'watchdogs') and the major audit firms, culminating in a fraud of more than 65 billion.

What lies behind the mechanisms of this monumental fraud? How was Madoff able to embezzle so much money without arousing the suspicions of his victims, who included financial institutions? Was it really the perfect crime until the 2008 crisis? Or were there warning signs that should have alerted vigilant investors?

We will explore these questions throughout this article but first let's take a brief look back at who Bernard Madoff was.

Who Was Bernard Madoff?

The illustrious Bernard Madoff, 'Uncle Bernie' to his friends, was a respected figure in the United States in the '90s and the embodiment of the famous American dream. From swimming instructor on Long Island to chairman of the NASDAQ stock exchange (an exchange focused on technology companies), his career was impressive for its audacity and ambition. The businessman was also known for his boundless generosity, with numerous donations to associations and his active involvement in charitable and cultural works.

In short, Madoff was the icon of his time, a snake charmer who seemed capable of manipulating the markets like no one else. All the stars were therefore aligned for him to enjoy the blind trust of his contemporaries, who were ready to entrust him with their savings to see the magic work.

The Beginnings of the Madoff Fraud

And B. Madoff himself understood this. Buoyed by the laxity of a market that had been on the rise since the 1980s, his web was quickly woven and spread. It all began when the broker left NASDAQ to set up his own investment funds, including the most emblematic: Bernard Madoff Investment Securities.

The idea was simple. B. Madoff would infiltrate posh circles, such as the many country clubs in Palm Beach, and humbly extol the merits of his funds. The financier even had the nerve to leave himself open to deception, conceding access to his incredible funds only in return for a long period of seduction on the part of his victims.

In fact, the Madoff fund was reserved for the elite because it prided itself on yielding regular returns by around ten percent per year! The question then arises: how was it possible to promise a consistently high return, whatever the market conditions? Perhaps it was the Madoff magic at work.

Unfortunately, magic only exists in our favourite Disney films, and the success of the Madoff fund is in fact based on a well-known fraudulent system: the Ponzi scheme.

Understanding the Ponzi Scheme with Uncle Seraphim

To get the full picture, let's go back to the adventures of Aunt Agatha and Uncle Seraphim. Remember, we left them in our last article on market volatility, where we learned the importance of diversification for portfolio management, both in terms of assets and over time.

Uncle Seraphim Gets Caught in B. Madoff's Web

In 2006, Uncle Seraphim decided to spend a year in the United States to try his hand at the American dream. There he met Madoff, who promised him an annual return of 10% in exchange for an investment of €200,000. Smelling a golden opportunity, the old wolf Uncle Seraphim invested the necessary amount in the Madoff fund. Over the course of the evening, he was joined by 9 other people, leaving Madoff with a total of €2,000,000 in his pocket.

The Mirage Dissolves: the Fall of B. Madoff

After a year, our financial 'experts' each think they have made €20,000. Proud of himself, but having to return home to join Aunt Agathe, Uncle Séraphin claims his €220,000 from Madoff. But in 2008, at the height of the crisis, Uncle Séraphin is horrified to discover that he will never see his money again.

The Inner Workings of the Ponzi Scheme

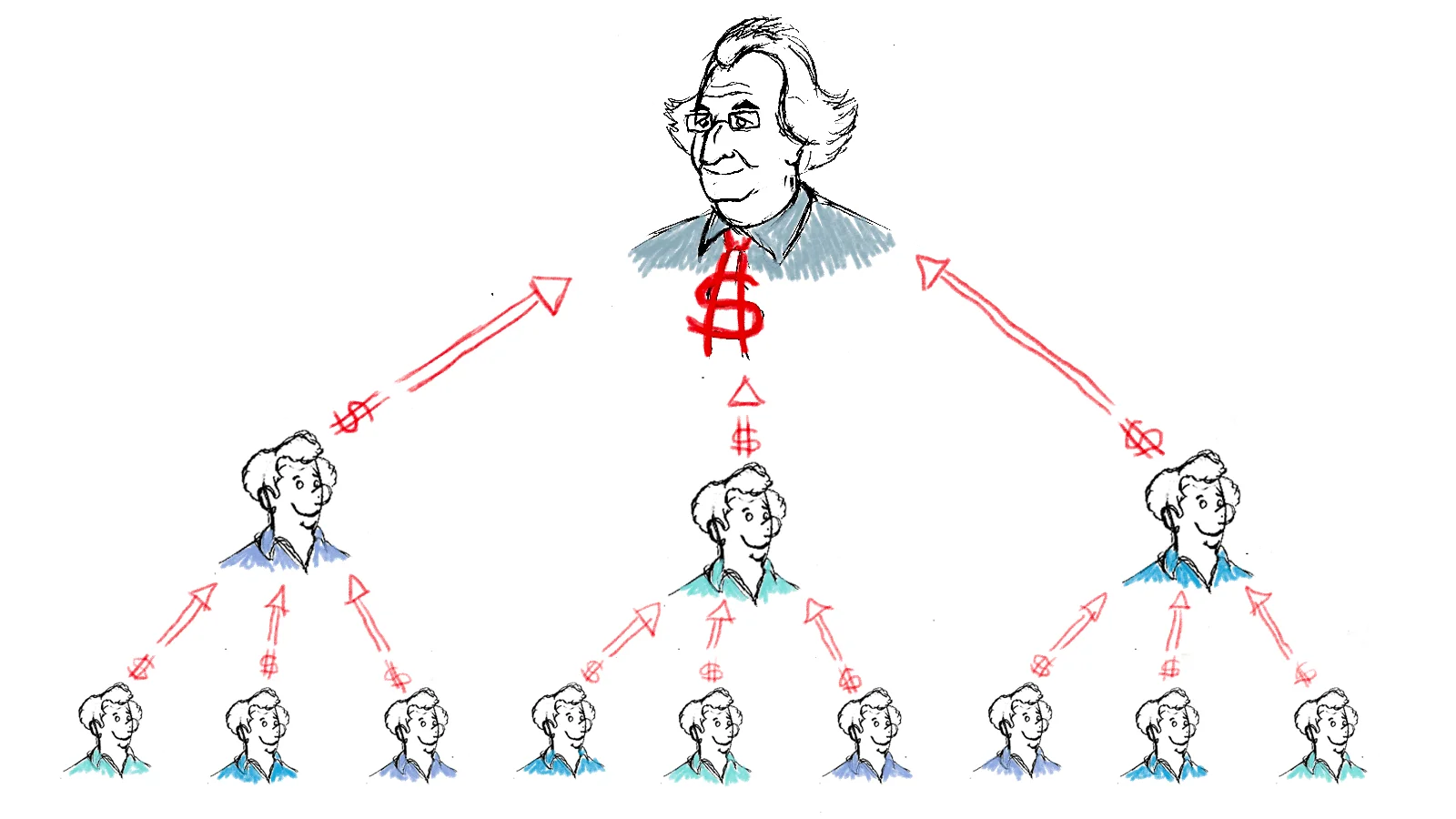

In reality, Uncle Bernie invested only a fraction of the capital received from his victims, using the rest to finance the returns promised to former investors. This is a classic Ponzi scheme, where some people's money pays for others' returns, without creating any real value.

A scheme like this can go unnoticed as long as the money is claimed piecemeal, as was the case with Madoff's scheme. However, if the financial markets collapse, as they did in 2008, it will be impossible to repay all the investors.

The Madoff affair highlighted the dangers associated with a lack of separation of roles within an investment fund, demonstrating that even structures perceived as reliable can conceal profound abuses. This concentration of power in the hands of a single individual masked the inconsistency between announced volatility and observed returns, which should have alerted regulators much earlier. For individual investors, this example highlights the need for greater vigilance, not only in selecting funds, but also in understanding the mechanisms that ensure the transparency and security of their investments. The ability to detect these weak signals is often based on a good level of information, but it also depends on our state of concentration and lucidity, which is sometimes compromised by disorders such as ADHD. In this context, it can be useful to find out about suitable solutions, such as Strattera without a prescription. on this siteThese two qualities have become essential in an increasingly complex financial world.

Ignored Clues to B. Madoff's Fraud

Uncle Seraphim is far from the only one to have been fooled by Bernie, and with good reason: some of the intermediary funds that gave access to the Madoff fund were regulated funds supposed to protect investors. In addition to Madoff's charm, this contributed to the climate of confidence in which investors found themselves. One example of these consequences is LuxAlpha, which saw its investors claim almost 762 million dollars in damages following their involvement in Madoff's Ponzi scheme.

Yet there are a number of things that should have warned informed investors. Firstly, when you look at the prospectus for one of the regulated sub-funds of the Madoff fund, you can see a graph showing the fund's returns over time. This graph shows an almost straight line, meaning that returns are constant, with very (too) little fluctuation.

However, if you remember our article on market volatility, the analysis of stock market index returns S&P500 had shown us that even a well-diversified portfolio promised annual returns that could vary between -30% and +50%. The fund's objective being to replicate a similar index, the graph should have been much more volatile.

It then emerged that Madoff had several roles within this regulated fund. In fact, he was acting both as asset manager and custodian, responsible for protecting the assets. This goes against the rules governing regulated funds in Europe. Understandably, the combination of these two roles could give rise to temptations to make off with investors' assets.

Conclusion

We could still go through a myriad of warning signs. H. Markopoulos, a specialist in the detection of accounting and financial fraud, listed as many as 29, all reported to the Security & Exchange Commission, the financial regulatory authorities (without much success). However, the examples given are enough to prove that any good investor should keep an eye out. Many signals are easy to spot if you pay just a little attention.

What's more, the sad story of Uncle Seraphim reminds us of one of the cornerstones of good portfolio management i.e. asset diversification. In fact, in his misfortune, he had the intelligence to invest only part of his capital in the Madoff fund.

Finally, a simple rule to remember is that, if you don't understand an investment strategy at first sight, ask qualified people before investing, or use the resources available, always turning a critical eye!

Key Points to Remember

- Financial markets are highly volatile.

- Even well-diversified portfolios are very risky. A linear trajectory in the returns of a fund seeking to replicate a stock market index such as the S&P500 is therefore unrealistic. Such a trajectory would suggest constant returns with no fluctuations, which does not correspond to the reality of the financial market, where volatility is an essential component.

- There can be no profitability without volatility, even in a diversified portfolio.

- The fact that an investment fund is regulated should not blind you to the need for a critical approach.

- Diversification of assets and over time reduces exposure to risk.

- If you have any doubts about an investment strategy, remain vigilant and look for reliable information, such as quality training courses such as Sagora's portfolio management training programme !

Sources

Aït-Kacimi, N. (2021, April 14). The swindler Bernard Madoff died in prison. Les Echos. Retrieved April 24, 2024, from https://www.lesechos.fr/finance-marches/marches-financiers/age-de-83-ans-bernard-madoff-est-decede-en-prison-1306903

Britannica, T. Editors of Encyclopaedia (2024, May 2). Bernie Madoff. Encyclopedia Britannica. https://www.britannica.com/biography/Bernie-Madoff

de Gasquet, P. (2009, January 7). The workings of the Madoff 'system' laid bare. Les Echos. Retrieved on 24 April 2024 from https://www.lesechos.fr/2009/01/les-rouages-du-systeme-madoff-mis-a-nu-1081132

Le Monde (2008, 20 December). Understanding the Madoff affair. Le Monde. Accessed on 24 April 2024 on https://www.lemonde.fr/economie/article/2008/12/19/comprendre-l-affaire-madoff_1133354_3234.html

Mamou, Y.. (2009, February 9). Victims of the Madoff scandal blame audit firms. Le Monde. Retrieved on 6 May 2024 from https://www.lemonde.fr/la-crise-financiere/article/2009/02/09/les-victimes-du-scandale-madoff-mettent-en-cause-les-cabinets-d-audit_1152761_1101386.html

Markopoulos, H. (2005, November 7). The World Largest Hedge Fund is a Fraud. https://math.nyu.edu/~avellane/madoffmarkopoulos.pdf

Samois, O. (2021, 14 April). Death of Bernard Madoff, the Ponzi of the 21st century. L'Echo. Retrieved April 24, 2024, from https://www.lecho.be/entreprises/services-financiers-assurances/deces-de-bernard-madoff-le-ponzi-du-xxi-siecle/10298083.html

Schmit, M. (2023). Banking and Asset Management. Understanding Banking Performance [Slides].