When it comes to preparing for our children's future, one crucial question arises: how do we invest intelligently? Quite often, the first instinct is to turn to low-risk financial instruments, such as savings accounts, life insurance or term accounts with a guaranteed rate. Savings accounts remain the most popular and reassuring option, with protected amounts of up to €100,000 per person and per bank. However, with returns struggling to keep pace with inflation, is this really the best long-term strategy?

Savings accounts: the false friend of your children's savings?

According to a study by the Camille family allowance fund, more than 70% of Belgian families who save for their children choose a savings account. Conversely, only 10% families dare to explore other options such as investment funds for fear of the risk.

It is legitimate to ask whether a savings account is really the most appropriate solution for building your child's capital. Between 2003 and 2023, the average annual return was just 1.11 % in Belgium, while inflation averaged 2 %. In other words, savings were not enough to offset the rise in prices over this period, resulting in a loss of purchasing power - which is a bit rich for a product designed to grow your children's capital.

Financial education in Belgium: a void that is costing savers dearly

This reluctance to take risks is largely due to a lack of confidence in the company.financial education. According to a Febelfin survey conducted in March 2024 among more than 2,000 Belgians, lack of knowledge is the second most important reason for not investing, just behind lack of means.

This is hardly surprising: economics is often optional, or even absent from portfolio management in Belgian secondary education, and few university courses offer in-depth training in financial concepts. This educational void leads to a lack of understanding of the opportunities offered by the financial markets and an exacerbated fear of loss for a large proportion of the Belgian population, while doing nothing entails a very real risk to let inflation erode the value of your savings.

Lessons from Aunt Agathe: invest to beat inflation

Now that we have put the savings account on trial, let's look at a concrete example of how an investment in an index fund could compare. Often shunned when it comes to saving for your children, these funds nonetheless harbour potential that is just waiting to be unlocked by careful, thoughtful management.

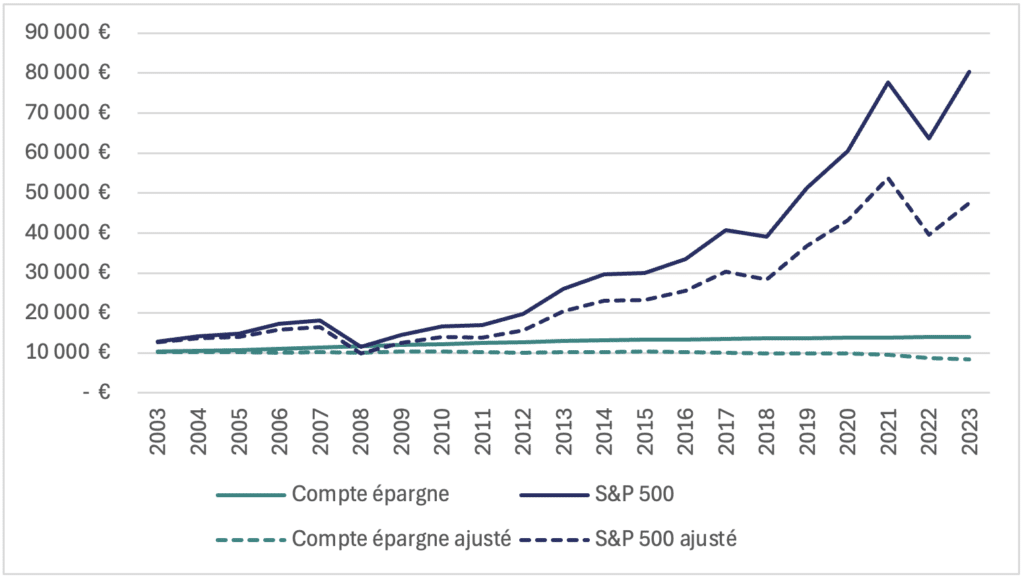

Let's meet our dear Aunt Agathe and her brother Uncle Séraphin. In 2003, these two happy grandparents decided to make a spontaneous donation of €10,000 to their grandchildren. Aunt Agathe, who was very familiar with the financial markets, decided to invest the money in a fund that replicated the S&P 500. Uncle Séraphin, on the other hand, is more cautious and opts for security by investing the same amount in a savings account.1.

The years went by and, in 2023, the results spoke for themselves: Aunt Agathe's grandson pocketed more than 80.000€ while Uncle Seraphim's granddaughter recovers... 14.000€. The picture is much bleaker when inflation comes into play. The graph shows that inflation has eaten away at the capital in the savings account, leaving Uncle Seraphim's granddaughter with less purchasing power than she had invested 20 years earlier.

Graph 1 - Evolution of the value of a €10,000 investment in an S&P 500 index fund and in a savings account from 2003 to 2023, compared with their inflation-adjusted value

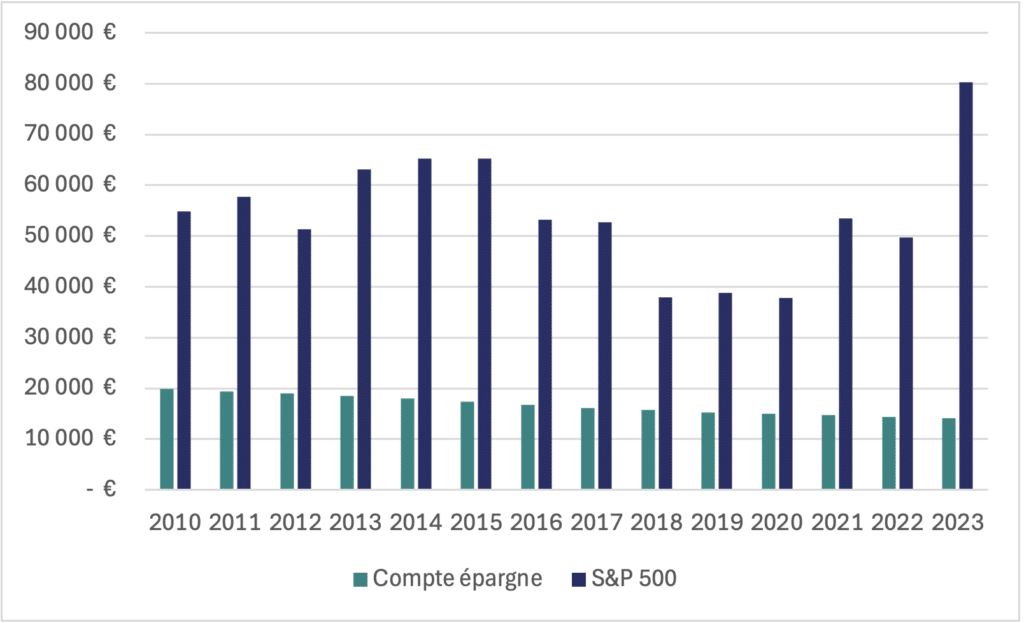

Long-term and diversification: the keys to success2

Tante Agathe hasn't just been lucky. Its success is based on a tried and tested strategy: investing in the long term and diversify your investments - both in terms of assets and over time. This temporal diversification, although omitted in our example for reasons of graphic clarity, is essential for smoothing the risks associated with market fluctuations. The Graph 2 is an illustration of this: the value obtained after 20 years from a one-off investment of €10,000 in an index fund replicating the S&P 500 systematically exceeds the performance of the savings account. However, these results vary considerably depending on the starting year.

This ability of stock market investments to outperform over the long term is also reflected in the overall figures: between 2003 and 2023, the diversified fund in which Tante Agathe invested generated an average annual return close to 10%. In comparison, the average annual yield of 1,64% offered by the savings account chosen by Uncle Séraphin pales into insignificance.

Long-term risk: a question of perspective

Of course, market volatility can be worrying in the short term. However, when it comes to a long-term investment, such as one made for a child, these fluctuations are generally absorbed over time. For example, an investment of €10,000 in a fund replicating the S&P 500 just before the 2008 crisis would have recovered its initial value in around four years, despite the market collapse.3.

That said, knowing your risk profile remains essential. Depending on your risk profile, it may be appropriate to diversify your investments with low-risk assets, even over the long term. However, the longer the time horizon, the more potential losses are mitigated and the greater the potential return. Consequently, a long-term investor is generally able to accept a higher level of risk than a short-term investor.

Graph 2 - Changes in the value of €10,000 after 20 years: comparison between a savings account and the S&P 500 (1990-2003)

Conclusion: don't let fear and inflation eat away at your returns

Investing regularly, either monthly or quarterly, in a well-diversified equity portfolio can help to tame market volatility while generating much higher returns than savings accounts.

Of course, financial markets carry risks, but not taking advantage of them and letting your savings be eroded by inflation is a risk in itself.

Don't let a lack of financial knowledge limit your returns and those of your children. Get trainedGain confidence and optimise your investments according to your objectives and risk profile. With Sagora's Portfolio Management courses, you're one step closer to a successful launch.

Would you like to effortlessly navigate the turbulent waters of the financial markets? Visit our website to find out more about our training programme in portfolio management !

#FinancialTraining #PortfolioManagement #PersonalFinance #Diversification #KnokkeSummerSchool

Sources

- Campart, S. (2018). And if we dared to invest? EMS Editions.

- Damodaran, A. (2024). Historical Returns on Stocks, Bonds and Bills: 1928-2023. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- French Republic, Public Service. (2023). Livret A. https://www.service-public.fr/particuliers/vosdroits/F2365

- The Livret A (France) annual returns are used for their ease of access to historical data. Bear in mind, however, that the average annual return on Belgian savings accounts is even lower than that on the Livret A (1.11 % compared with 1.64 % on average). ↩︎

- This article is based on the performance of the US market, in particular the S&P 500. It is important to note that these results should not be extrapolated to all investment funds, particularly European funds, which have not necessarily performed comparably. By way of illustration, the Euro Stoxx 50 index took more than 16 years to return to its pre-2008 crisis level. ↩︎

- Please note that past performance is no guarantee of future performance. ↩︎