Does a monkey invest better than you (or Aunt Agathe)?

You can't teach Wall Street's old monkeys how to invest

Burton Malkiel, a renowned economist, wrote in his book "A Random Walk on Wall Street" that "a blindfolded monkey throwing darts at the financial pages of a newspaper could select a portfolio as successful as one carefully chosen by experts." According to B. Malkiel, neither the monkey nor the portfolio manager can outperform the benchmarks, because share prices move randomly. This bold statement was seen as an affront to active fund management, leading to a series of experiments to test its validity.

To better understand this story, let's follow Aunt Agathe. You may remember her and her inheritance from our article on market volatility. Eager to invest her small fortune and intrigued by this story about monkeys, she decides to find out more.

Robert Arnott's experience

The most famous experiment to evaluate B. Malkiel's statement was carried out by Robert Arnott and his team. They simulated the choice of a monkey by randomly selecting 100 portfolios of 30 stocks from among the 1,000 largest market capitalisations, with each stock having the same weighting in the index. This process was repeated every year from 1964 to 2012. And it worked! Beyond Burton Malkiel's predictions, the monkeys beat the market 96 times out of 100.

The success of chimpanzees: between chance and expertise

Should Aunt Agathe then run to the chimpanzee enclosure and entrust them with her entire inheritance? Well, not exactly. It's all a question of weighting. In traditional index funds like the S&P 500, the weight of each company depends on its market capitalisation. In contrast, the Monkey Index weights each company fairly, giving more weight to small caps by default. These small companies have attractive growth potential and can offer substantial returns, offsetting the losses of other stocks. In fact, if we applied a fair weighting to a traditional index, it would outperform the experimental monkey index funds.

However, as Nicolas Nassim Talebthe famous writer and statistician, if you put an infinite number of monkeys in front of typewriters, one of them will end up typing an exact version of the Iliad. But would you bet your life savings on that same monkey going on to write the Odyssey? For Aunt Agathe, no way!

The extraordinary performance of a few stocks chosen at random does not guarantee that every choice will be a winner. Small caps can be very profitable, but they are also more volatile. Although original, Aunt Agathe is reluctant to invest her parents' hard-earned money in this kind of diversified random strategy. The idea of beating the market by letting a monkey choose the shares was above all a humorous way of illustrating that a random diversified investment strategy can perform just as well as an identical risk strategy devised by experts.

The efficient markets hypothesis

However, this experience illustrates an important point: the hypothesis of efficient markets in their semi-strong form. According to this hypothesis, market participants behave in a totally rational manner, and prices should reflect all publicly available information. So if everyone has the same information about a company and everyone is rational, then everyone should attribute the same price to that company's shares. The opposite would mean that some players possess privileged information.

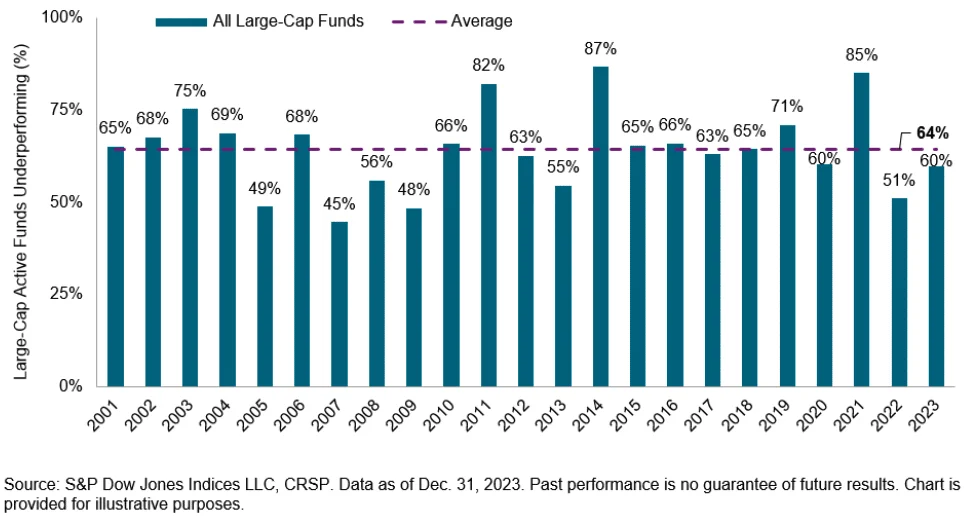

If this hypothesis is true, on average, it would be complicated for fund managers to consistently outperform the market or to do better than a random portfolio (like that of the monkeys). This is illustrated in the Figure 1This is the 14th consecutive year that the majority of large-cap active managers have underperformed the S&P 500.

Figure 1 - Most actively managed US large-cap equity funds have underperformed the S&P 500 20 out of 23 years.

Reducing costs to maximise returns

In conclusion, Burton Malkiel does not compare experts to monkeys simply to provoke, but to illustrate that the stock market often follows the principles of efficient markets. Robert Arnott's experience shows that random choices can sometimes outperform those of experts. Consequently, minimising management fees (which are higher under active management) by adopting passive management and investing in diversified index funds may be a wise strategy for Aunt Agathe and many other investors.

That said, there is nothing to stop you reserving a small part of your money, which you are prepared to risk, for active management. After all, the markets are not always perfectly rational. Your adviser will be able to offer you a varied range of products, such as investments in private equity, real estate or commodities. He or she will also be able to offer you comprehensive financial services, such as tax and wealth planning, to optimise the management of your assets throughout your life cycle. Although Robert Arnott's experience calls active management into question, it in no way detracts from the added value of these personalised services.

Would you like to effortlessly navigate the turbulent waters of the financial markets? Visit our website to find out more about our training programme in portfolio management !

#FinancialTraining #PortfolioManagement #PersonalFinance #Diversification #KnokkeSummerSchool

Sources

- Ernst J. Fahling, Mario Ghiani, Diethard Simmert (2020). Small versus Large Caps-Empirical Performance Analyses of Stock Market Indices in Germany, EU & US since Global Financial Crisis. https://www.researchgate.net/publication/347402716_Small_versus_Large_Caps-Empirical_Performance_Analyses_of_Stock_Market_Indices_in_Germany_EU_US_since_Global_Financial_Crisis

- Louapre David (2013). Would a monkey do better than your financial adviser? Sciences étonnantes. https://scienceetonnante.com/2013/11/04/un-singe-ferait-il-mieux-que-votre-conseiller-financier/

- Robert D. Arnott, Jason Hsu, Vitali Kalesnik and Phil Tindall (2013). The Surprising Alpha From Malkiel's Monkey and Upside-Down Strategies. https://thereformedbroker.com/wp-content/uploads/2014/11/jpm_summer2013_rallc.pdf

- Schmit, M. (2023). Banking and Asset Management. EU Fund Industry [Slides].

- (n.a.). (2022). The monkeys that beat the market. Market Sentiment https://www.marketsentiment.co/p/the-monkeys-that-beat-the-market