Taming risk: a winning long-term gamble

Navigating stock market fluctuations

" You can't stop the waves, but you can learn to surf them "(Joseph Goldstein)

Stock markets are often a rollercoaster ride. Alternating between rises and falls, booms and busts, they make less experienced investors shudder. The value of your investments can plummet from one year to the next. For example, an investment of €10,000 in 2004 would have risen to more than €14,000 in 2007, only to fall to less than €9,000 the following year. These uncertainties may have already put a damper on your investment decisions, encouraging you to opt for safer investments such as government bonds. And yet.., by applying the right practices, a portfolio of equities proves to be much more profitable over the long termeven with higher volatility.

The superiority of long-term shares

"In the stock market, the distant future is easier to predict than the near future" (Robert Schiller, Nobel Prize in Economics 2013)

To illustrate this point, let's look at three types of asset: government bonds, 10-year government bonds and a portfolio of shares in an index fund such as the S&P 500.

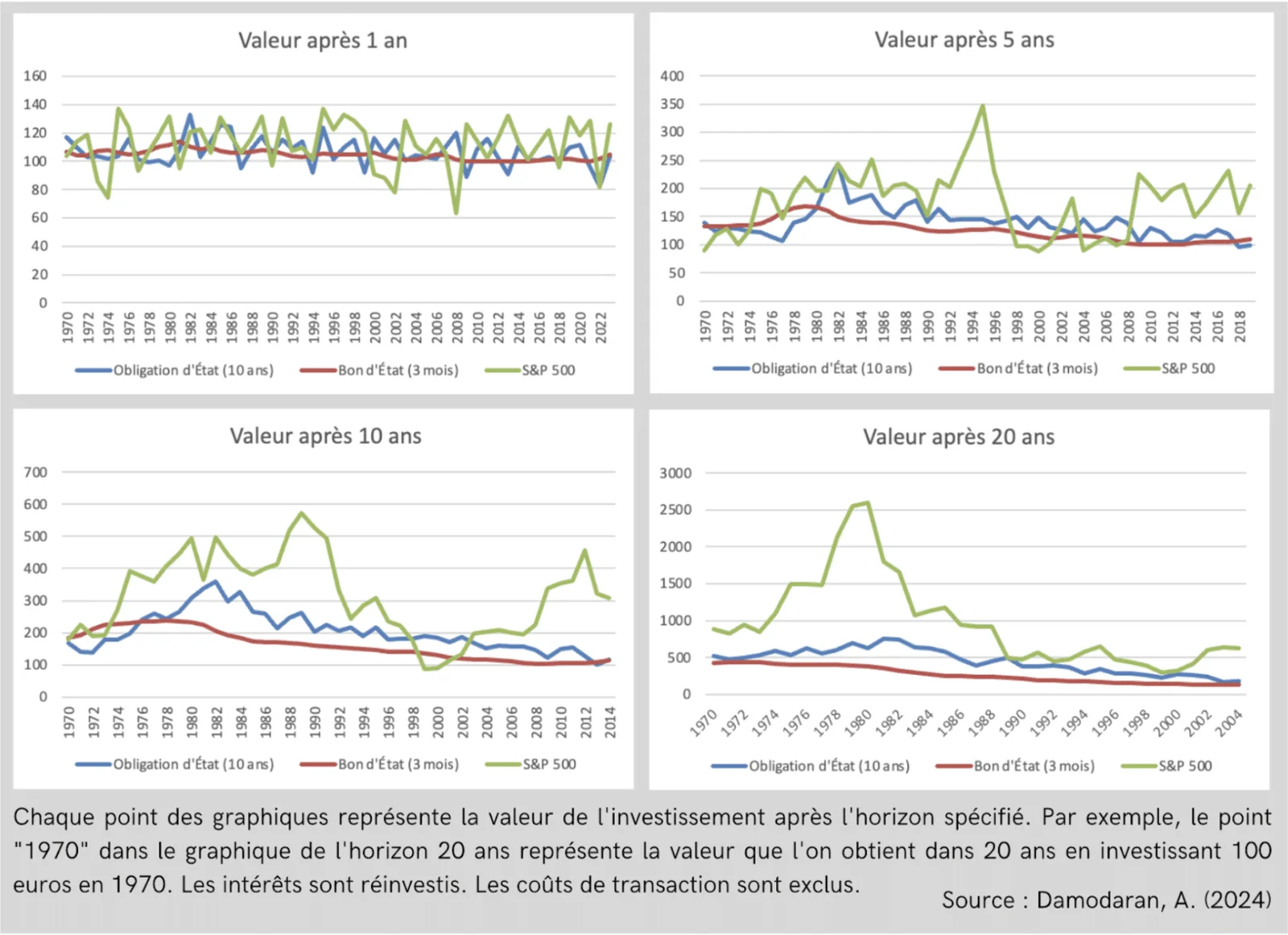

Let's invest 100 euros in each of these assets and analyse the results over different time horizons (Figure 1). Over five years, the value at horizon of €100 invested in an S&P 500-type index fund fluctuates much more, and is sometimes even worth less, than €100 invested in bonds or government bonds, due to the greater volatility of equities. This phenomenon also occurs over 10- and 15-year horizons, although less frequently as the investment period lengthens. On the other hand, over 20 years, the value at the horizon of our 100 euros invested in equities systematically exceeds the value of those invested in bonds and government bonds, illustrating the following the long-term superiority of diversified equity portfolios such as the S&P 500 in terms of returns, despite their initial volatility.

So, with a few exceptions, equity returns are much higher over the long term. For example, in 1989, an investment of 100 euros over a 20-year period yielded 'only' 500 euros, a return similar to that on a government bond. This 'anomaly' can be explained by the bursting of the internet bubble in 2000, after a period of strong economic growth marked by the technological explosion of the 1990s. This was followed by a fall in yields when the stock market collapsed in October 2008, as a result of the financial crisis triggered by the collapse of Lehman Brothers in September of that year. These successive crises, although rare, are significant. This is why diversification over time is of crucial importance. to smooth out the risks of successive crises and take advantage of diversified market conditions.

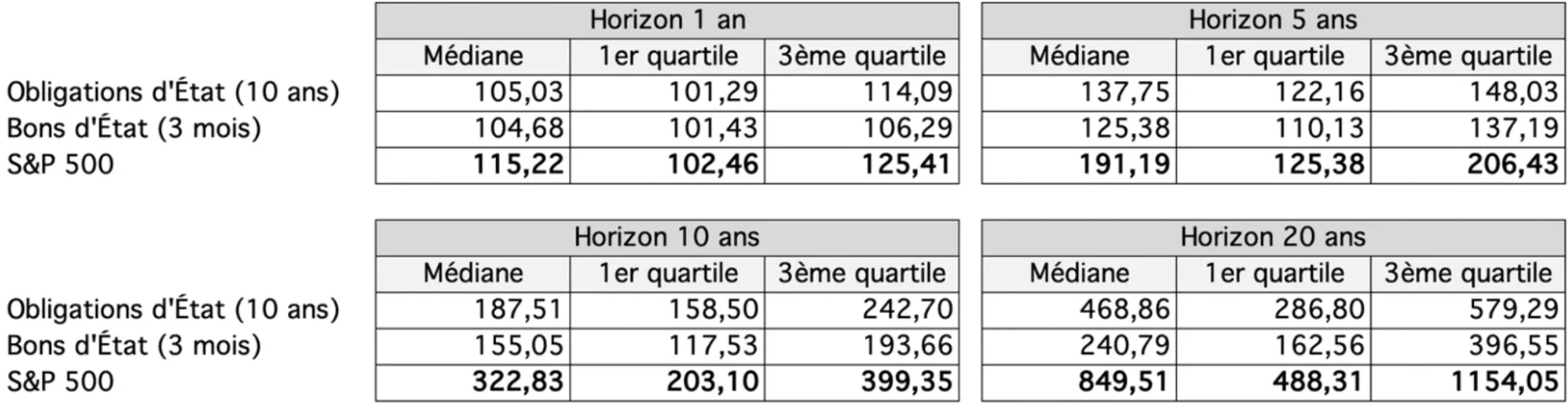

The superiority of equities can also be seen in their median return, which is always higher than that of bonds and government bonds, whatever the time horizon (Table 1).

Figure 1 - Charts showing the value of €100 invested in 3 types of asset over different time horizons on a historical basis between 1970 and 2023

Table 1 - Statistical summaries of data in euros for horizons of 1 to 20 years on a historical basis between 1970 and 2023

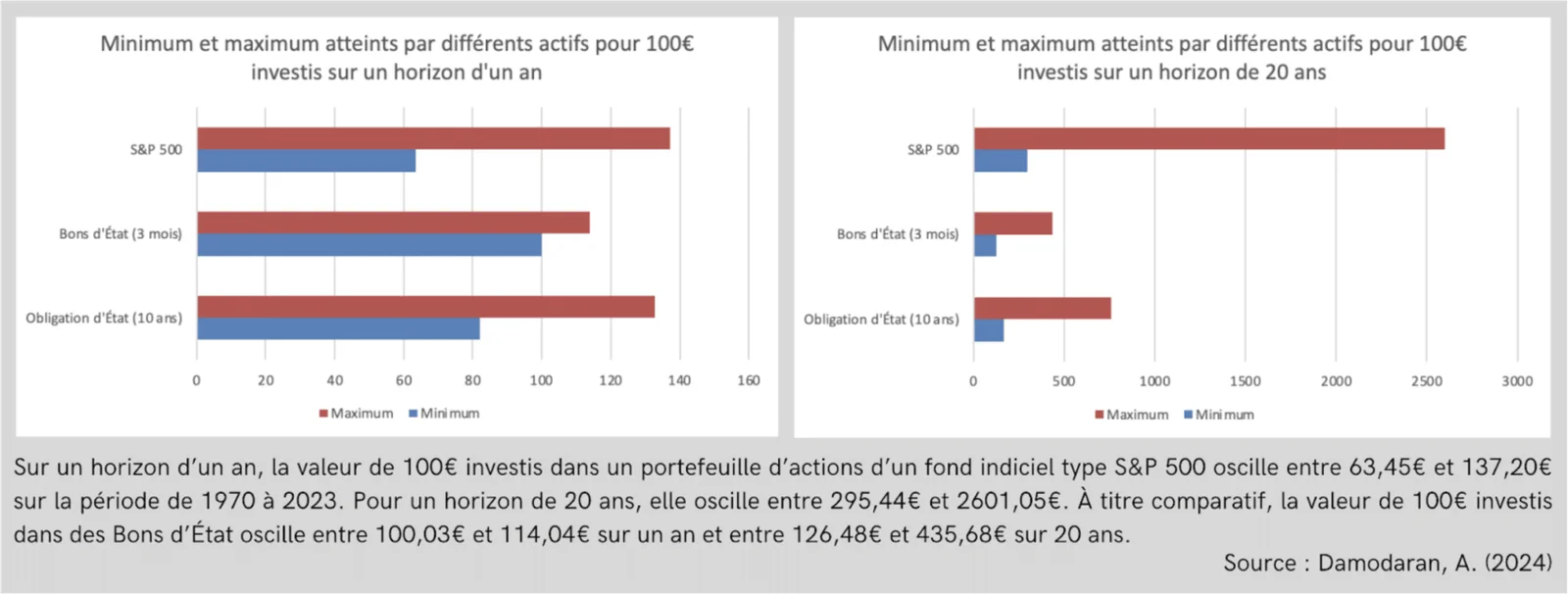

Unfortunately, we can't have it both ways. As we have already mentioned, equities are subject to significant market volatility. In the short term, therefore, their minimum return is lower than that of safer assets. However, their maximum return is much higher. What's more, over the long term, even the minimum return on equities outperforms that on government bonds and bills (Figure 2).

However, the minimum and maximum are not very robust in the face of extreme values and should therefore be interpreted with caution. We have deliberately used them because extreme events should not be ignored, but for a more faithful representation of the data trend, it is preferable to opt for the quartiles, which are less sensitive to outliers.. Never limit your analysis to a single measure, but use it in conjunction with other indicators to obtain the best possible representation of reality.

Figure 2 - Graphs showing the minimum and maximum values of 100 euros invested over 1 and 20 years for 3 different types of asset on a historical basis between 1970 and 2023.

Conclusion

"Good things come to those who wait". (Clément Marot)

In conclusion, over the long term, investing in a portfolio of equities offers substantially higher returns than bonds and government bonds, despite the high volatility of the markets. So you don't always have to shy away from risky assets, as long as you tame the underlying risks by rigorously applying the principles of asset diversification and temporal diversification. In short, don't be afraid to add a little spice to your finances, as long as you know how to balance the flavours!

Would you like to effortlessly navigate the turbulent waters of the financial markets? Visit our website to find out more about our training programme in portfolio management !

#FinancialTraining #PortfolioManagement #PersonalFinance #Diversification #KnokkeSummerSchool

Sources

- Damodaran,A. (2024). Historical Returns on Stocks, Bonds and Bills: 1928-2023. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- Dehon, C. (2024). Introduction to robust statistical techniques [Slides].

- Tretina, K. (2023, August 9). What is the S&P 500? How does it work? Forbes. https://www.forbes.com/advisor/investing/what-is-sp-500/