A company’s financial flows are based on four main activities: operations, financing, investments, and dividend distribution1. Yet, many business leaders assume that a quick glance at the balance sheet and income statement is enough to get a full picture of their financial situation. This is a common and risky mistake. By neglecting cash flow analysis, they overlook a crucial dimension of financial management and make decisions without completely understanding reality and seeing the full picture. Indeed, it is not uncommon for profitable companies to go bankrupt simply because their leaders fail to distinguish between accounting profit and actual cash flow2.

To avoid these pitfalls, analysing the cash flow statement is your best ally. Before celebrating a misleading profit, make sure you have a complete view of the situation: where financial resources come from, how they are invested, and whether your business is generating more cash inflows than outflows.

What is the cash flow statement?

The cash flow statement shows where a company’s money comes from and how it is spent over a year. It is divided into four sections, each reflecting a key aspect of financial management:

- Cash flow from operating activities (Operating cash flow): represents cash inflows and outflows related to the company’s daily operations, such as selling products or services and paying suppliers. This is where a company’s true performance is measured.

- Cash flow from investing activities (Investing cash flow): covers cash flows related to the purchase and sale of assets, whether tangible (new machinery) or intangible (patents or financial assets).

- Cash flow from financing activities (Financing cash flow): includes cash movements related to funding sources, such as bank loans or capital contributions from shareholders.

- Cash flow from dividend policy: when approving annual accounts, a company may decide to distribute a portion of its profit to shareholders or partners. This is known as dividend distribution. It represents a direct cash outflow that must be carefully managed to avoid liquidity issues.

The sum of these four components determines the company’s cash flow variation over a given period. This is expressed by the following equation, where CF represents cash flow:

A practical case to better understand

In 2020, driven by her entrepreneurial spirit, Jane, Aunt Agathe’s niece, decided to launch Agathe&Co, a company specializing in traditional hat making, inspired by her old aunt’s signature style. Let’s take a closer look at how her cash flow statement evolved between 2021 and 2024 to better understand her journey.

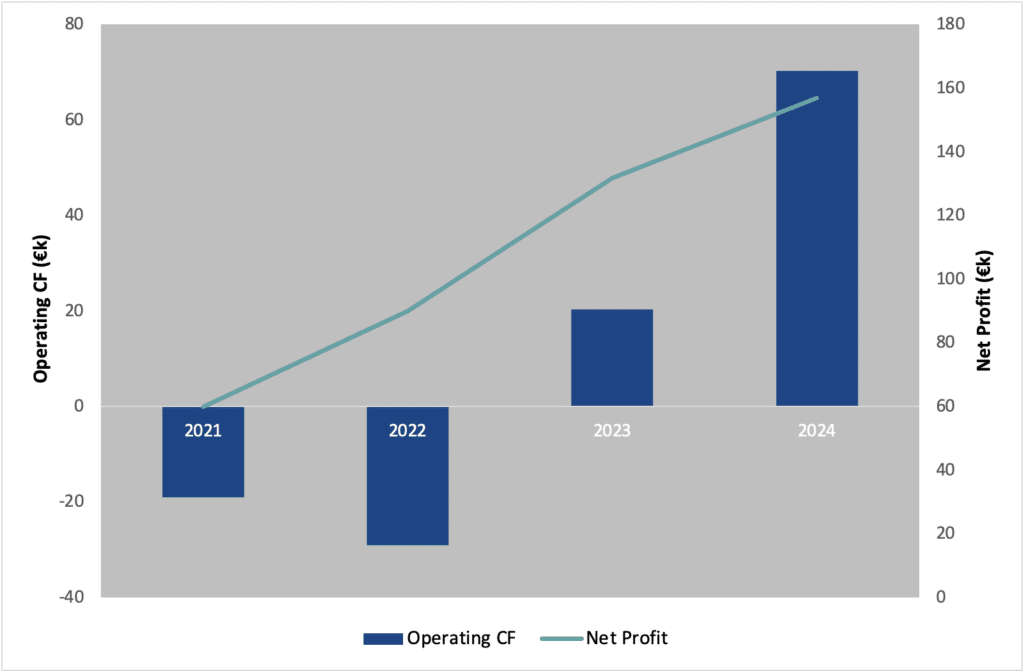

Graph: Evolution of Agathe&Co’s Operating Cash Flow vs. Net Profit from 2021 to 2024 (€k)

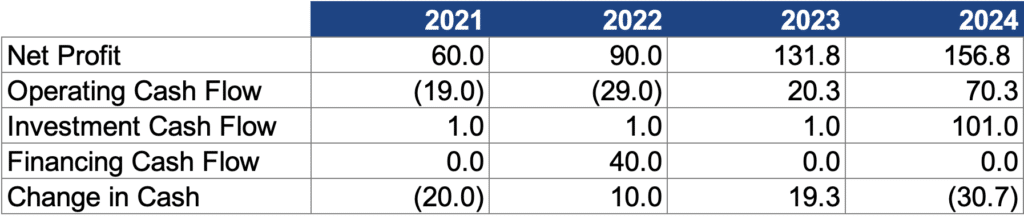

Summary Table: Evolution of Agathe&Co’s Cash Flows and Net Profit from 2021 to 2024 (€k)

A dream too good to be true

The first year goes smoothly. The « Agathe » hats gain popularity among elderly ladies. At this stage, Jane isn’t too concerned about her finances and decides to seek help the following year from an « expert »—her Uncle Séraphin, who happens to be Aunt Agathe’s brother. He sets a sales target for 2021, ensuring the financial health of the business. By the end of the year, the target is met, and Jane is overjoyed: Agathe&Co. reports a positive net profit of €60,000!

Reality check: Jane loses her hat… and nearly the shirt off her back!

One evening, proudly reviewing her 2021 accounts, Jane stumbles upon an unfamiliar document: the cash flow statement. She decides to go through it and notices something alarming—her operating cash flow and cash variation for the year are negative. Jane may not be a finance expert but she has enough common sense to realize that this is not a good sign.

After some research, she comes to a shocking realization: her business isn’t actually generating cash from its hat sales. Worse, it’s losing money.

Her « expert » Uncle Séraphin reassures her, insisting that increasing sales targets for the following year will fix her operating cash flow issues. Unfortunately, things only get worse in 2022, with an even larger operational cash deficit.

Debt as a quick fix

With Agathe&Co.’s cash position deteriorating, Uncle Séraphin suggests taking out a short-term loan to bridge the gap until things improve.

At first glance, this seems to work—the company’s cash balance turns positive. However, nothing has fundamentally changed in its operations. Borrowing to cover operational losses only creates future obligations (debt repayments and interest) without addressing the root cause. In the long run, this could make the company’s financial situation even worse.

The core issue: payment terms and inventory management

Disappointed by her uncle’s advice, Jane turns to Aunt Agathe for help. With her guidance, she discovers that the real problem lies in how the company manages payment terms and inventory.

Agathe&Co.’s elderly customers like to take their time. Not used to online payments, they often wait for their grandchildren to visit before settling their orders. Meanwhile, Jane must pay her suppliers upfront, as they don’t trust her yet. On top of that, she maintains a large stock to prepare for seasonal sales. These factors create serious cash flow problems.

As long as Agathe&Co. continues to grow on this shaky foundation, its cash position will keep deteriorating. Sales may increase, and net profit may remain positive, but there is a timing mismatch between when Agathe&Co. collects payments and when it must pay suppliers, forcing Jane to constantly advance funds. Every new sale, instead of bringing in immediate cash, increases the amount of capital locked in operations.

Hats off to Jane!

After long negotiations with her suppliers, Jane manages to extend her payment terms. She also considers reducing customer payment delays by offering better tracking and more convenient payment methods. Additionally, a more disciplined inventory strategy would help her manage seasonal fluctuations more effectively.

These adjustments ease the strain on cash flow, allowing Jane to commit fewer funds upfront for day-to-day operations. By 2023, Agathe&Co. finally generates cash from its operations and achieves a positive cash flow variation.

The following year, cash variation turned negative again, but this time, for a good reason. Agathe&Co. still maintains a positive operating cash flow, but Jane, confident in her

company’s future, decides to invest €100,000 in new sewing equipment and store renovations. While this temporarily reduces cash, it is an investment that will support the company’s long-term growth.

Conclusion

Jane’s story perfectly illustrates how appearances can be deceiving and why the cash flow statement is a crucial financial management tool.

Despite rising sales and positive net profits, Agathe&Co.’s cash flow situation was alarming—something that didn’t appear in the balance sheet or income statement. Poor stock and payment management meant the company had to front cash to finance operations. If left unaddressed, increasing sales would only worsen the funding gap and deepen the cash flow deficit.

It’s like hosting a banquet where you have to pay for all the food upfront—the more guests you invite, the more money you need to cover the costs, risking running out of cash before anyone reimburses you.

Moreover, a positive cash variation doesn’t always mean financial health. For instance, Agathe&Co.’s cash position improved in 2022 due to a loan, but this didn’t solve the real operational problems. Likewise, a negative cash variation isn’t always bad—it may simply reflect investments in the company’s future growth.

Ultimately, a superficial reading of financial statements can paint a very misleading picture. That’s why every manager must understand cash flow movements before making strategic decisions.

So, why not take the time to learn? Our “Finance for Managers” training program will give you the tools to master financial analysis and recognize misleading financial situations, such as the impact of sales growth on cash flow.

Visit our training page for more information.